Yesterday, the U.S. Securities and Exchange Commission (SEC) released its indictment against Sam Bankman-Fried. It details the financial entanglements of FTX, Alameda Research and more than a hundred other companies and individuals. We have tried to disentangle these allegations somewhat for you.

Of course, the presumption of innocence also applies to Sam Bankman-Fried, or SBF as he is commonly called. However, some of the accusations seem at least plausible, since they coincide with earlier reports from insiders. Let’s look at the two crypto companies at center stage, both founded by SBF and friends.

The German 🇩🇪 original is available as «Das Spinnennetz der Kryptobörse FTX» (or here).

The companies

Alameda Research

Caroline Ellison, then 26, formally co-CEO as of October 2021 and CEO of billion-dollar Alameda Research as of August 2022. Image source: Former website of Alameda Research.

Almost exactly 5 years ago, in November 2017, Sam Bankman-Fried and others founded Alameda Research to predict and realize cryptocurrency profits using financial mathematical methods. In January 2018, initial arbitrage trades made about 20 million in profits. Arbitrage means taking advantage of price differences of the same security in different places around the world. In particular, Alameda Research bought “cheaper” bitcoins in the U.S. to sell them directly back at a higher local rate in Japan.

FTX

In May 2019, Sam Bankman-Fried and Gary Wang founded FTX. The company enabled its clients to trade multiple crypto tokens and derivatives. It achieved daily trading volumes equivalent to several billion dollars and promised secure and segregated handling of client funds on its website.

SEC allegiations

The allegations are of investor fraud, in particular fraud surrounding the offer, purchase, or sale of securities.

The 28-page indictment lays out the corporate and financial entanglements and accuses SBF of knowing about them and—in some cases—personally carrying them out or ordering them.

In particular, the following allegations emerge:

- Alameda Research and FTX had been very closely intertwined. Not only was Alameda Research a market maker on the FTX platforms, particularly for FTX’s own FTT token, but the firms were also very closely linked, including sharing office space and employees.

- It was not the formal CEO(s) of Alameda Research who were responsible for Alameda’s decisions. Instead, both companies were managed by SBF himself. Thus, SBF not only knew about the interconnections, he also orchestrated them.

- The corporate network consisted of over 100 companies, allegedly with the aim of concealing activities.

- In particular, bank accounts had been shared very generously between the two companies. For example, most customers who thought they were transferring money to FTX were actually transferring money to a bank account owned by Alameda Research. Alameda Research would also have direct access to accounts that officially belonged to FTX.

- Alameda Research was something like SBF’s personal piggy bank, from which he could draw at any time. He used it to buy luxury real estate, support political campaigns, make risky private investments, and donate generously. (According to a recent interview, his commitment to the Effective Altruism movement was largely a fig leaf to make the world see him in a better light).

- Alameda’s direct access to FTX customer and investor funds had not been properly documented, either to investors or in its accounting records.

- US$8 billion that had gone directly to Alameda had simply been described as “fiat@ftx.com”.

- The billions in loans automatically triggered interest claims in the accounting system. To avoid them showing up in the books (and also for tax purposes), the funds were moved to an inconspicuous third-party account on Bankman-Fried’s instructions.

- The audited books, which were shown to investors, would not have listed these billions. (I suspect that the auditors which had confirmed the books to be correct will still have a few sleepless nights).

Reading the indictment like this, it seems that there must have been significant criminal energy behind it. Something like a WireCard 2.0 (or rather 4.0?)…

Disentangling the finances

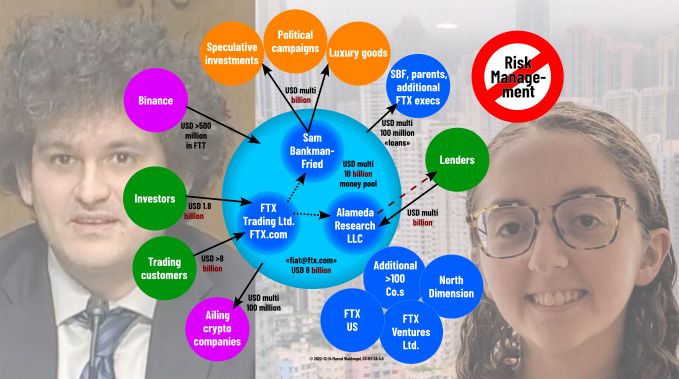

My attempt at reproducing the financial relationships from the SEC complaint.

Green: funders; dark blue: FTX firms and individuals; light blue: de facto financial pool of major players; orange: “private pleasure”; purple: crypto firms. The word “billion” is highlighted in red, to distinguish it from “just” millions.

FTX allegedly had received US$ 1.8 billion from investors and over US$ 8 billion from customers. However, this money did not actually flow directly to FTX (International or US), but rather into a pool of money from which Alameda Research and SBF in particular could freely help themselves. Connected to this are more than 100 companies, three of which are mentioned by name in the indictment.

In addition to SBF’s remuneration, another several hundred million had also been given as “loans” to SBF, his parents, and other responsible persons around FTX.

Other key investments included several billion from lenders to Alameda and over 500 million worth of FTT tokens from Binance. As recently as this summer, the FTX conglomerate has come to the aid of several crypto companies in distress, probably to avoid further weakening confidence in cryptos as a whole.

But when some of the lenders wanted their loans back (red dashed line), the house of cards had collapsed.

According to the SEC complaint, despite grandiose claims to the contrary, there had been no risk management whatsoever.

Conclusions

Blockchain advocates criticize the current economic system as being plagued by greed, inefficiency, lack of transparency, and excessive complexity. However, the goal toward which these advocates work, is a new, now digital, economy, plagued by greed, inefficiency, lack of transparency, and excessive complexity.

Marcel Waldvogel in “Hitchhiker’s Guide to the Blockchain“

Even if the crypto apostles keep painting the future of cryptocurrencies in bright colors and vehemently defend themselves against any Ponzi scheme accusations: Reality once again proves them loudly wrong.

FTX was one of the big, shining stars in the crypto firmament. However, the indictment clearly shows that the shining of this star is based on unfair machinations. The very regulations that cryptocurrency defenders are constantly angry about were created to prevent this.

Yes, even in the traditional financial world, such machinations are not always recognized in time, as the currently ongoing trial on the Wirecard case just shows once again. Another thing both cases have in common: The auditors were also deceived (or let themselves being deceived?).

The “just” € 1.9 billion that were missing at Wirecard is significantly less what is missing at FTX now; and compared to the crypto crashes in the past months alone, almost insignificant. (And this already without having to make comparisons about the total volume of the TradFi and DeFi industries).

The multi-billion FTX conglomerate was seemingly built with the purpose of being as complex and opaque as possible to satisfy the greed of a few for as long as possible.

It is also astonishing how carelessly a multi-billion company conglomerate could be managed; but it is also astonishing how gullible investors and customers were (or, maybe, wanted to be): As long as huge profits were advertised, greed apparently clouded the vision of everyone involved.

Addendum (2022-12-24)

Caroline Ellison and FTX co-founder Gary Wong have pleaded guilty for fraud and have been collaborating with the authorities. Something that has been previously rumored. Sam Bankman-Fried is on bail, with ankle monitor. It is a record bail of USD 250 Million, which is secured mostly by his parents home, valued at only a small fraction. Part of it is symbolic, especially as federal regulations essentially require bail under these circumstances, as explained here.

Blockchain ecosystem

More posts in the blockchain ecosystem here, with the latest here:

- The year in review

This is the time to catch up on what you missed during the year. For some, it is meeting the family. For others, doing snowsports. For even others, it is cuddling up and reading. This is an article for the latter.

This is the time to catch up on what you missed during the year. For some, it is meeting the family. For others, doing snowsports. For even others, it is cuddling up and reading. This is an article for the latter. - NFTs are unethical

As an avid reader, you know my arguments that neither NFT nor smart contracts live up to their promises, and that the blockchain underneath is also more fragile and has a worse cost-benefit ratio than most believe. Similarly, I also claim the same for the metaverses built on top of them all. And that the… Read more: NFTs are unethical

As an avid reader, you know my arguments that neither NFT nor smart contracts live up to their promises, and that the blockchain underneath is also more fragile and has a worse cost-benefit ratio than most believe. Similarly, I also claim the same for the metaverses built on top of them all. And that the… Read more: NFTs are unethical - Inefficiency is bliss (sometimes)

Bureaucracy and inefficiency are frowned upon, often rightly so. But they also have their good sides: Properly applied, they ensure reliability and legal certainty. Blockchain disciples want to “improve” bureaucracy-ridden processes, but achieve the opposite. Two examples:

Bureaucracy and inefficiency are frowned upon, often rightly so. But they also have their good sides: Properly applied, they ensure reliability and legal certainty. Blockchain disciples want to “improve” bureaucracy-ridden processes, but achieve the opposite. Two examples: - The FTX crypto exchange and its spider web

Yesterday, the U.S. Securities and Exchange Commission (SEC) released its indictment against Sam Bankman-Fried. It details the financial entanglements of FTX, Alameda Research and more than a hundred other companies and individuals. We have tried to disentangle these allegations somewhat for you. Of course, the presumption of innocence also applies to Sam Bankman-Fried, or SBF… Read more: The FTX crypto exchange and its spider web

Yesterday, the U.S. Securities and Exchange Commission (SEC) released its indictment against Sam Bankman-Fried. It details the financial entanglements of FTX, Alameda Research and more than a hundred other companies and individuals. We have tried to disentangle these allegations somewhat for you. Of course, the presumption of innocence also applies to Sam Bankman-Fried, or SBF… Read more: The FTX crypto exchange and its spider web - Web3 for data preservation? (Or is it just another expensive P2P?)

Drew Austin raises an important question in Wired: How should we deal with our accumulated personal data? How can we get from randomly hoarding to selection and preservation? And why does his proposed solution of Web3 not work out? A few analytical thoughts.

Drew Austin raises an important question in Wired: How should we deal with our accumulated personal data? How can we get from randomly hoarding to selection and preservation? And why does his proposed solution of Web3 not work out? A few analytical thoughts. - Rejuvenation for Pro Senectute through NFT and Metaverse?

Pro Senectute beider Basel, a foundation to help the elderly around Basel, launched its NFT project last week and already informed about its Metaverse commitment beforehand. According to a media release, Michael Harr, managing director of the 15-million Basel-based company, wants to use the purchase of these “properties” in a “central location” in two online… Read more: Rejuvenation for Pro Senectute through NFT and Metaverse?

Pro Senectute beider Basel, a foundation to help the elderly around Basel, launched its NFT project last week and already informed about its Metaverse commitment beforehand. According to a media release, Michael Harr, managing director of the 15-million Basel-based company, wants to use the purchase of these “properties” in a “central location” in two online… Read more: Rejuvenation for Pro Senectute through NFT and Metaverse?